If you are an executive, ask yourself:

- Are you worried about attending meetings at work in which financial jargon and maths will be used?

- Do concepts like enterprise value and current ratio confuse you?

- Would fluency in the “language of business” lead to a job promotion?

For Learning & Development heads:

- Would you like more financially confident employees?

- Would you like your high potential executives think strategically like owners of the business?

- Would you like your key staff be able to make good money decisions on behalf of the company?

- Should all your personnel be able to communicate effectively using the “language of business”?

If you have answered “yes” to the questions above, then this course is for you and your team.

Warren Buffett, the world’s greatest investor, says “Finance and Accounting is the language of business”.

At the end of this course, you will be empowered to:

- “Cut the wheat from the chaff” i.e. set aside the noise, that is, too much irrelevant data.

- Know which terms and numbers to pay attention to, and why.

- Understand the relationship between key concepts so as to deduce what actions are most urgent or important for your organisation right now.

- “Foretell the future” using available information and a spreadsheet.

No matter where you work in your organisation, you’ll do your job better if you understand basic financial concepts. Why? Because finances affect every aspect of business. Participants of this program will be able evaluate opportunities and uncover gaps and leaks that can be fixed to reduce waste. Empowered by this knowledge, leaders within business units can make better strategic decisions.

What’s more: You’ll have fun using real world and live cases, while gaining some life changing skills.

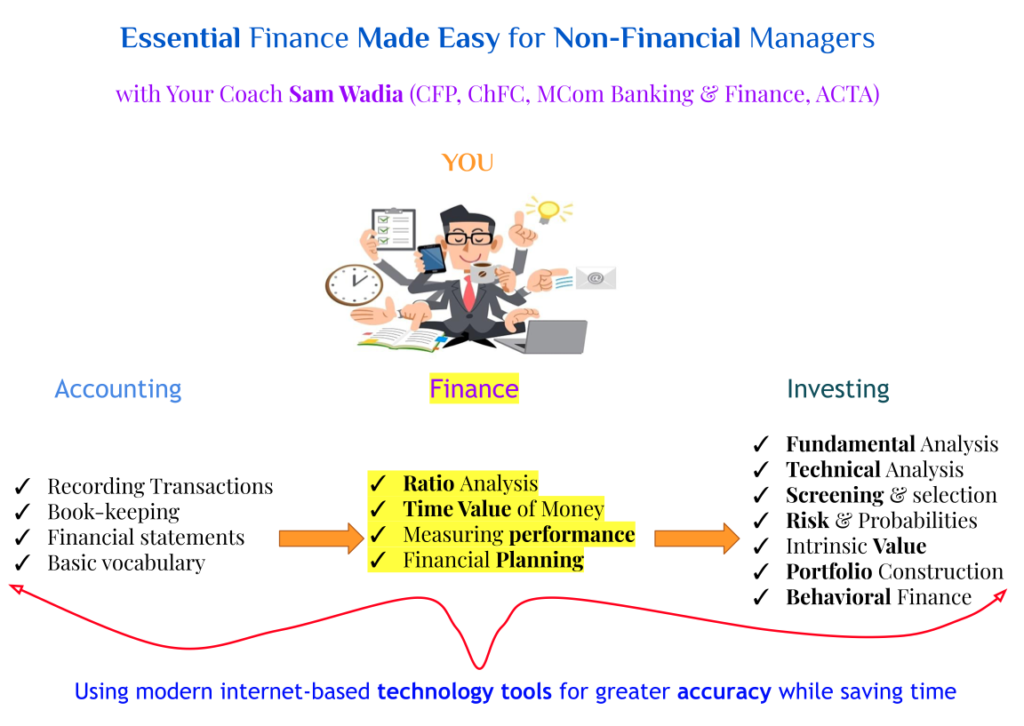

Finance For Non-Financial Managers

Course Highlights

What You Will Learn

- Understand and apply key financial terms

- Understand and interpret various types of financial reports

- Identify and analyse important data for decision making

- How to deal with financial situations that impact your work and life

In Basics of Finance 2-day course for decision-makers, these are the topics typically covered:

[1]

The vocabulary of finance – the language of business

Understanding terms such as debit, credit, journal entry, trial balance, owner’s equity, and amortisation.

[2]

Introduction to accounting and financial statements

Understanding the three fundamental reports – balance sheet, income statement and, cash flow statement.

[3]

Financial analysis using ratios

Making sense of a company’s health by comparing various key numbers in logical process – and against competitors in the same industry.

[4]

Managing operating performance

Using ratios and other criteria to gauge how well the company is doing over the years.

[5]

Managing assets and liabilities

Evaluate how well the company has allocated its resources for maximum sustainable growth.

[6]

Risk vs return

Understanding what risk is, and its relationship with potential returns or profit.

[7]

Time value of money

Calculating real returns, effective interest rate, net present value and discounted cash flows (DCF).

[8]

Investment valuation

How to deduce the intrinsic worth of an asset – based on your logical assumptions and specific preferences of investors.

[9]

Capital decision-making

How to structure a portfolio or balance sheet that is most suited to the goals and preferences of the investor or company respectively.

[10]

Financial planning primer

The process of putting together all the knowledge above into systematic steps for selecting a set of solutions that work harmoniously to reduce our risk as we reach our goals.

[11]

Bonus: Behavioural Finance

Since human beings are often driven by emotions, learn how to recognise our natural biases and avoid common errors of judgement in our investment decisions.

Based on the book Financial Literacy for Managers published by Wharton School Press, and Finance Basics for Managers published by Harvard Business Press.

Learning Delivery Methods

To make learning enjoyable, participants are kept engaged throughout the workshop using some or all of the following:

Games ➤ Graphs, Flow Charts and Videos ➤ Real-Life Case Studies ➤ Appreciative Inquiry (AI) ➤ Group Discussions ➤ Presentations ➤ Practical Exercises ➤ Quizzes and Polls

Who should attend

This program is vital and directly applicable, for good reasons, to the following professionals:

CXOs ➤ Directors ➤ Heads of Departments ➤ High-Potential Executives ➤ Bankers ➤ Relationship Managers ➤ Business Analysts ➤ Engineers & Technical Experts ➤ Sales Leaders ➤ Administrative Supervisors

About your trainer

Sam Wadia has over 15 years of experience as a licensed wealth advisor, certified trainer and investor.

Testimonials

“Enjoyed every minute… Ideas that seemed complex are now crystal clear.”

ST Tang, Senior Vice President

JP Morgan Chase

“Engaging experience with powerful lessons. Inspiring!”

Colin Choo, Associate Director – Real Estate

Propnex

“The stories were relevant, the action ideas were practical. The exercises in class using real data were the best… can’t wait to apply the ideas.”

Gary De Souza, Manager – Risk & Control

Standard Chartered Bank

Other 1 day courses

(1) Behavioral Finance – Knowing and avoiding top human misjudgments and cognitive biases that affect our investing decisions

(2) Explaining Investment Products – How to position, prospect for, and promote beneficial solutions to increase sales for Financial Advisor Representatives

(3) Gems on the floor – How to screen for and evaluate “cheap yet good” investments that the market has ignored

(4) Investment Planning Basics – How to construct a portfolio that matches your goals

(5) The Intelligent Investor – key lessons from Warren Buffett’s favourite book by his mentor Benjamin Graham

Bespoke courses available. Programmes can be customised to suit the needs of our clients. Please contact us to learn more.